Bank Muamalat And TASConnect Transform SME Supply Chain Financing With Digital, Shariah-Compliant Solutions

Bernama, 3 September 2025

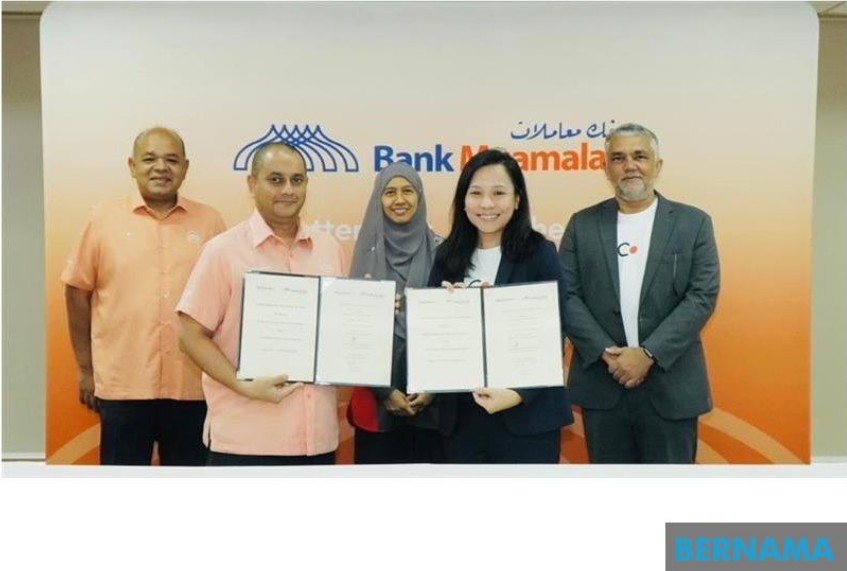

From left: Datuk Khairul Kamarudin, PCEO of Bank Muamalat; Dato’ Nazir, Director of Commercial Banking, Bank Muamalat; Mrs. Juanita Rusmini, COO of SJPP; Ms. Chan Tse Ning, Country Executive of TASConnect; and Mr. Kingshuk Ghoshal, CEO of TASConnect, at the MoU Signing Ceremony between Bank Muamalat and TASConnect to accelerate SME financing access through digital innovation.

From left: Datuk Khairul Kamarudin, PCEO of Bank Muamalat; Dato’ Nazir, Director of Commercial Banking, Bank Muamalat; Mrs. Juanita Rusmini, COO of SJPP; Ms. Chan Tse Ning, Country Executive of TASConnect; and Mr. Kingshuk Ghoshal, CEO of TASConnect, at the MoU Signing Ceremony between Bank Muamalat and TASConnect to accelerate SME financing access through digital innovation.

KUALA LUMPUR, Sept 3 (Bernama) -- Bank Muamalat Malaysia Berhad (Bank Muamalat) is pleased to announce a strategic collaboration with TASConnect, a leading digital supply chain finance platform, to provide enhanced and more accessible financing solutions for Small and Medium Enterprises (SMEs) across Malaysia.

SMEs can now access working capital more seamlessly, with faster approvals, improved financing terms, and reduced dependence on heavy collateral. With TASConnect’s platform, Bank Muamalat can deliver quicker financing approvals, enhanced transparency, and efficient disbursements, which significantly improves turnaround time for SME financing. With the backing of the Government Guarantee Scheme Madani for SMEs (GGSM), administered by Syarikat Jaminan Pembiayaan Perniagaan Berhad (SJPP), the bank’s risk exposure is reduced, enabling financing for a wider spectrum of SMEs.

(Web Source: https://www.bernama.com/en/press/news.php?id=2463500)